A market update by David Wagner from Aptus Capital Advisors

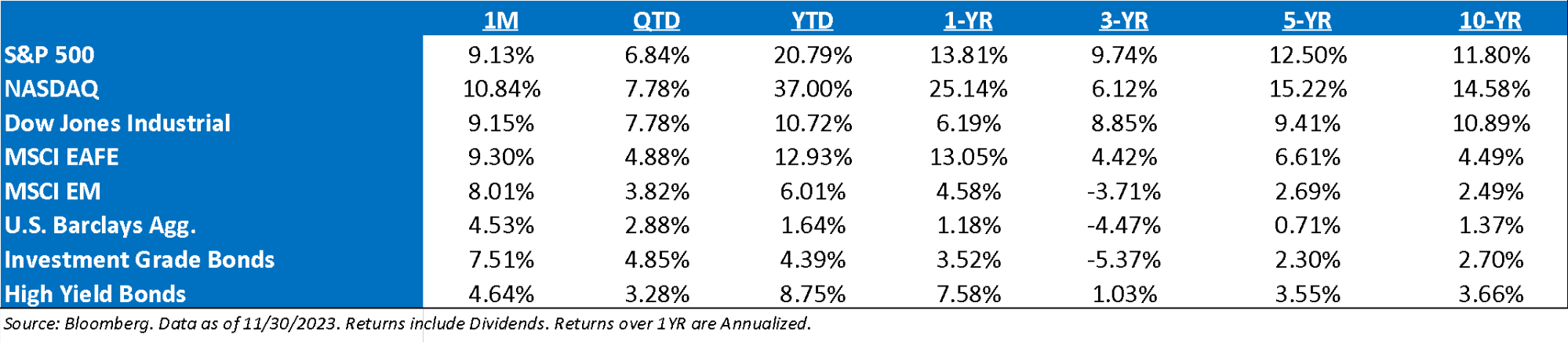

November ’23 Market Recap: After a 20% drawdown in many stocks between July and October, equities staged an impressive rebound in November thanks to the sharp reversal in interest rates. A good portion of this reversal was due to the pricing of a much more accommodative rate cut path over the next 12 months. Specifically, 130bps of cuts are now priced into Fed Funds futures through the end of next year—a dovish expectation in the context of stable economic growth in 2024. The driver of lower Treasury yields was slowing economic data globally, continuing the trend of “deceleration”, with PCE prices, ISM manufacturing, October consumer spending, holiday spending (according to NRF), China PMIs, and Europe inflation all showing signs of deceleration, and outright weakness from an economic standpoint. As we’ve continued to state, yields rule everything around investors.

Soft Landing Or Just Passing Through to a Recession? The equity markets are happy to support a soft landing thesis for now as the bond market is just taking economic weakness as a reason to send yields lower. However, the mathematical truth is that it is impossible to know whether we are just passing through growth rates consistent with a soft landing before slowing into a recession or whether the economy will stay at growth rates similar to today.

The Equity Volatility Tax: Since Nov. 8th, 2020 (Pfizer vax approval), every major benchmark average return is within 2% of each other. All the various style and size changes have just been giant reversions to the mean. Don’t get whipsawed by the equity volatility tax. Since then, the S&P 500 is up 10.30% annually, while the S&P 400 and S&P 600 are up 8.63% and 7.92%, respectively. It may not feel like it after the substantial difference in return numbers between ’22 and ’23.

It’s Been a Lopsided Market: Continuing the point above, the total return of the equal-weighted S&P 500 Index is up a mere +8.1% while the total return of the standard market-cap weighted Index is up +21.5%. When it comes to style performance, the performance differences are even greater. The Russell 3000 Growth Index is outperforming the Russell 3000 Value Index by a stunning 29%, the largest difference (ex-Covid) since 1999. It should be noted that Value normally bounces back after such lopsided underperformance.

Next Year’s Earnings Profile: Although expectations for S&P 500 earnings in 2024 have moderated to a degree, the Street is still expecting nearly a 12% increase in profits after what is likely to be a flattish year in 2023. As it stands now, the expectations largely come down to the earnings power of the Technology and Communications sectors. EPS has been quite negative year-over-year in 2023 despite real GDP and the labor market being better than expected. The best evidence is nominal means much more to earnings than real. Nominal growth should continue to decelerate in 2024, as consensus EPS seems far too optimistic for that reality.

November Fed Meeting: The revised “dot plot” from the September meeting was hawkish, but the November meeting felt slightly more dovish after the recent rise in nominal yields. With no surprise to the market, the Fed left their target fed funds rate between 5.25% and 5.50%. Unlike the September edition, the accompanying statement at least implicitly offered a justification for skipping this time, with the expanded reference to “tighter *financial* and credit conditions” that “likely” weigh on the economy, albeit still to an “uncertain” extent. This language seems rather tame, notably sandwiched in a second paragraph that’s seemed long-in-the-tooth and due a refresh. The hiking cycle has now meandered from its previous every-other-meeting groove, arguably largely, if not exclusively, on this account. Still, as the Chair conveyed at the presser, tighter conditions must persist to alter the path of monetary policy meaningfully.

Framing the Small Cap Landscape: The Russell 2000 rallied 9.1% in November, making it the 3rd best November going back to ’79. However, small still trailed large and QQQ. The YTD gap between the Russell 2000 and the Russell 1000 is the widest since ’98, while it’s the widest since ’99 vs. the QQQ.

Leaving Investors With Some Charlie Munger Quotes: 1) “The big money isn’t in the buying or selling, but in the waiting”, 2) ”People with high IQs are terrible investors because they’ve got terrible temperaments”, 3) “Acknowledging what you don’t know is the dawning of wisdom”, 4) “Invest in a business any fool can run, because someday a fool will”, and 5) “Assume life will be really tough, and then ask if you can handle it. If the answer is yes, you’ve won”.

What Concerns Us the Most: In short: 1) Continued volatility; 2) Inflation transitions to growth frustration; 3) The potential for a Fed policy error and continued collateral damage; 4) A general tendency to think about the economy and stock prices in V-shaped terms, i.e., a Fed Pivot saving the day.

Earnings: ’24 S&P 500 EPS = 246 (+11.5%). 2023 = $220 (+0.8%). 2022 = $219 (+7.4%). 2021 = $204. 2020 = $136. 2019 = $161. *

Valuations: S&P 500 Fwd. P/E (NTM): 19.0x, EAFE: 13.2x, EM: 11.6x, R1V: 14.6x, and R1G: 25.5x.*

*Source: Bloomberg and FactSet, Data as of 11/30/23

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members. Raymond James does not provide tax or legal services. Please discuss these matters with the appropriate professional.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The NASDAQ composite is an unmanaged index of securities traded on the NASDAQ system. Dow Jones Industrial Average (DJIA) commonly known as “The Dow” is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal. The MSCI EAFE (Europe, Australasia and Far East) index is an unmanaged index that is generally considered representative of the international stock market. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market. The MSCI Emerging Markets is designed to measure equity market performance in 25 emerging market indices. The index’s three largest industries are materials, energy, and banks. Inclusion of these indexes is for illustrative purposes only. The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represent approximately 8% of the total market capitalization of the Russell 3000 Index. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. Past performance is not a guide to future performance, future returns are not guaranteed, and a loss of capital might occur.

High-yield bonds are not suitable for all investors. The risk of default may increase due to changes in the issuer’s credit quality. Price changes may occur due to changes in interest rates and the liquidity of the bond. When appropriate, these bonds should only comprise a modest portion of a portfolio.